- #Irs married filing jointly tax brackets 2021 how to#

- #Irs married filing jointly tax brackets 2021 free#

The preceding list may be daunting but, rest assured, collecting all this information beforehand will save a lot of grief when it comes time to sit down and fill out your tax forms.

To give yourself the best chance of success and reduce the chances of a frustration headache, the first order of business should be to collect every possible document or bit of information you could possibly need to fill out the appropriate forms. Hopefully, the following information will make your life easier. Calculating and filing annual taxes has become increasingly complicated and a task most of us do not look forward to each time April 15th rolls around. Over the years, citizens have despised the existence of an income tax system whilst sometimes enjoying the governmental benefits it provides. It was a protest against unjust taxes that led to the formation of our country when we broke away from England over tea imports. The history of taxation in the United States is an important one. Since we're not into the macabre, let's talk about taxes. The old saying goes nothing in life is certain except death and taxes. Marginal Versus Effective Tax Rates: How Much Do You Really Pay? From the select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. There are also a few other types of income subject to quarterly taxes.īasically, if you’re earning income through anything other than a W-2 job that automatically withholds them for you, you’ll need to file estimated taxes.Need Extra Funds to Cover Your Tax Obligations? Homeowners: Leverage Your Home Equity Today

#Irs married filing jointly tax brackets 2021 free#

Not sure how much you’ll owe? You can use our free quarterly tax calculator to figure it out! Quarterly taxes for non-self-employment income If you’re self-employed and expect to owe at least $1,000 in taxes next year, you’ll need to get a jump start on your payments by making estimated quarterly taxes. Will you need to pay quarterly estimated taxes? Not sure what kind of deductions you qualify for? The Keeper app will find them for you automatically based on the kind of 1099 work you do That way, you never miss an opportunity to save!

This is true whether you’re a solopreneur making millions, a side hustler taking on weekend projects, or a full-time gig worker. The result is your “net self-employment income.”įor example, if your gross income from 1099 work is $35,000, but you spent $5,000 on work-related expenses throughout the year, your net self-employment income would be $30,000.Įveryone who works for themselves, even a little, gets to take out the cost of doing that self-employed work.

Step #1: Subtract what it costs to run your business or side hustleīefore you even get to the standard deduction, freelancers get to subtract business deductions from their self-employment income.

#Irs married filing jointly tax brackets 2021 how to#

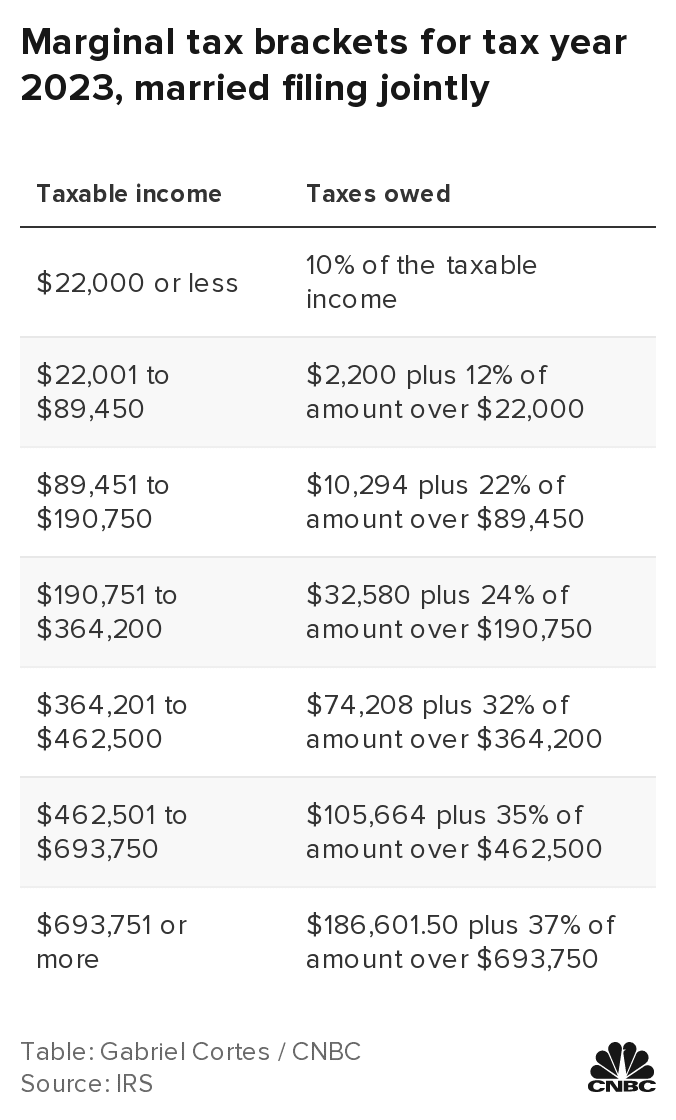

Here’s how to calculate your taxable income.

0 kommentar(er)

0 kommentar(er)